Creating the Perfect Portfolio for Financial Success

- Nate Carter

- Jan 24

- 4 min read

Building a durable investment portfolio is essential for achieving financial freedom. The perfect portfolio mix is a carefully balanced combination of assets designed to maximize returns while managing risk to provide long-term growth, income, and safety.

A typical portfolio includes a variety of asset classes such as stocks, bonds, real estate, and sometimes commodities such as precious metals. The goal is to create a portfolio that performs well in different market conditions. Below we discuss diversification and rebalancing and as well as sequence-of-return risk. We also provide three prominent portfolios for consideration when designing your own investments.

Diversification Matters

Diversification reduces risk by spreading investments across different types of assets. If one asset class underperforms, others may perform better, smoothing out overall returns. For example, stocks might drop during a recession, but bonds or real estate could hold steady or even increase in value. Including commodities in your portfolio can be a hedge against inflation.

Rebalancing Matters

With any portfolio the mix of investments will change over time as one asset class performs better than others. Over time, rebalance your portfolio once a year to maintain the appropriate ratios in your portfolio. Investors often use their birthday as the date to rebalance so they do not forget.

Timing Matters

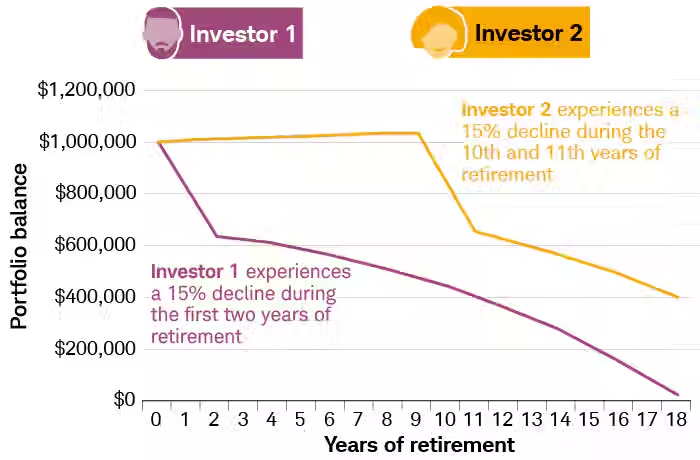

One caveat for all new retirees regarding their portfolio is sequence-of-return risk. This refers to the timing of negative returns in the early years of retirement. If your portfolio suffers a double-digit decline in the first five years of retirement, it is wise to suspend withdrawals. This will provide the portfolio time to recover, otherwise, the longevity of your portfolio may be cut in half.

Some retirees set aside a year or two of annual expenses in high yield savings accounts or certificates of deposit to protect against sequence-of-return risk. If a retiree avoids significant declines in the first five years, this risk has mostly passed. Schwab Center for Financial Research provides the chart below to show the risk of a 15% decline in portfolio value in the first two years of retirement versus in the 10th and 11th years of retirement.

Key Components of a Balanced Portfolio

Equities (Stocks): Provide growth potential through capital appreciation and dividends. A mix may include both U.S. and international stock funds.

Fixed Income (Bonds): Offer steady income and lower volatility.

Real Estate: Adds income and diversification benefits.

Cash or Cash Equivalents: Provide liquidity and safety.

Alternative Investments: Include commodities such as gold or exchange traded futures for further diversification.

The exact mix depends on your financial goals, risk tolerance, and investment horizon. Below are three popular portfolio allocations for consideration. It is important to review and back test the performance of your portfolio before investing.

Golden Ratio Portfolio

Frank Vasquez, the host of the Risk Parity Radio podcast, is credited with creating the Golden Ratio Portfolio, the allocations are below.

% Asset Class

21% Large Cap Stocks (i.e. Vanguard Growth Index Fund, symbol VUG)

21% Small Cap Stocks (i.e. Atlantis US Small Cap Value, symbol AVUV)

26% Long Term Bonds (i.e. Vanguard Long-Term Treasuries, symbol VGLT)

16% Gold (i.e. symbol GLD)

10% Managed Futures (i.e. exchange traded fund, symbol DBMF)*

6% Certificates of Deposit, or Ultra Short-Term Bonds, symbol VUBFX)**

*As an alternative to managed futures, 10% may be invested in real estate such as Vanguard Real Estate fund, symbol VNQ.

** Investors already holding cash equivalents such as certificates of deposit outside of this portfolio may consider allocating this 6% to International Stocks (i.e. Vanguard Total International, symbol VXUS)

The All Weather Portfolio

The All Weather Portfolio was created by Ray Dalio founder and chief investment officer of the world’s largest hedge fund, Bridgewater Associates. Ray has also written books on economic patterns and business principles.

% Asset Class

30% Large Cap Blend of Stocks (i.e. Vanguard Growth Index Fund, VUG)

40% Long Term Bonds (i.e. Vanguard Long-Term Treasuries, VGLT)

15% Intermediate Term Bonds (i.e. Vanguard Interm. Bonds, symbol BIV)

7.5% Commodities (i.e. exchange traded fund, symbol DBMF)

7.5% Gold (i.e. exchange traded gold fund, symbol GLD)

The Richer Retirement Portfolio

William Bengen is credited with coming up with the 4% safe withdrawal rate rule in October 1994 in his article Determining Withdrawal Rates Using Historical Data. In 2025, William Bengen released his book A Richer Retirement which provides more clarity on determining a safe withdrawal rate that is 4.7% or higher per year.

% Asset Class

11% Large Cap Stocks (i.e. Vanguard Growth Index Fund, symbol VUG)

11% Medium Cap Stocks (i.e. Vanguard Mid-Cap Fund, symbol VO)

11% Small Cap Stocks (i.e. Atlantis US Small Cap Value, symbol AVUV)

11% Micro Cap Stocks (i.e. iShares Micro-Cap ETF, symbol IWC)

11% International Stocks (i.e. Vanguard Total International, symbol VXUS)

35% Intermediate Term Bonds (i.e. Vanguard Interm. Bonds, symbol BIV)

5% Ultra Short-Term Bonds, symbol VUBFX)

5% Certificates of Deposit, or Ultra Short-Term Bonds, symbol VUBFX)

If you want to learn more about retirement planning and steps to take before turning 50, see Turning 50: Ten Factors to Consider part 1 and part 2.

For more detailed information on taxes in retirement and creating a plan for financial independence see Become Loaded for Life and the 10 Stages Workbook.

Comments